AS SEEN IN

AS SEEN IN

BUDGET

Create a budget aligned with your goals.

Understand how much money is left after you pay your bills.

Identify which parts of the month you may feel tight on cash and why.

SAVE

Identify how much money you have available to save.

Use the calculator to determine when you'll reach your savings goals.

Determine which pay periods you can save more. Create a budget aligned with your goals.

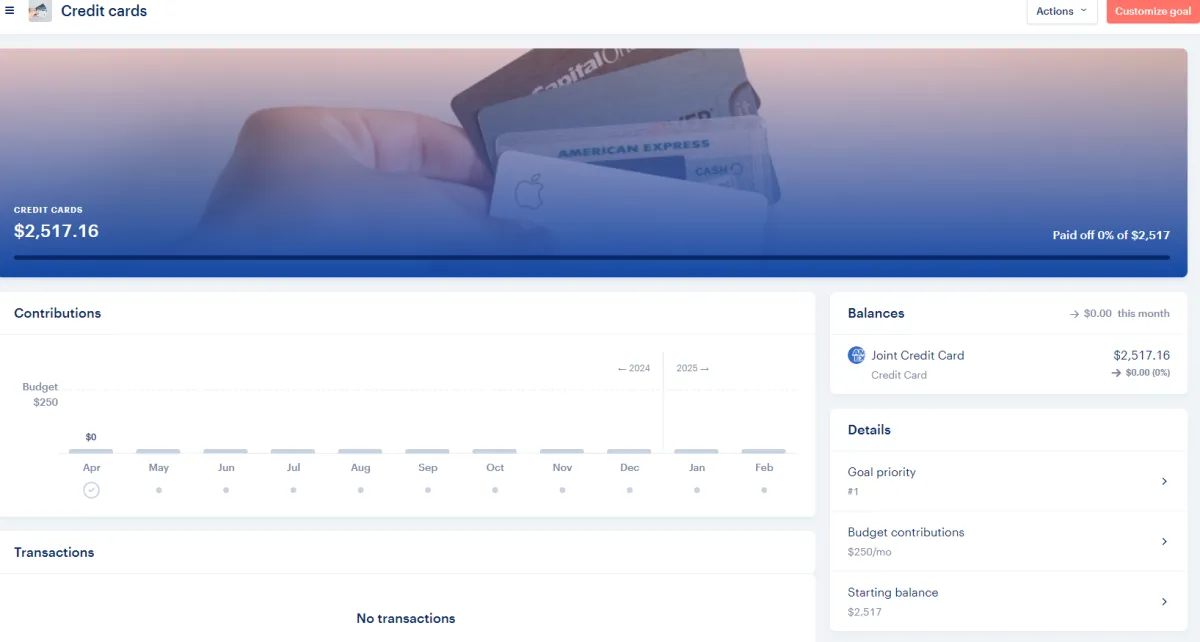

PAY OFF DEBT

List all your debt for easy organization.

Determine how much you can afford for extra payments

Know when you will have each debt paid off.

PLAN YOUR FINANCIAL GOALS

The best investment strategy comes from having a plan in place.

Identify your financial goals to align your strategy to choose the best investments.

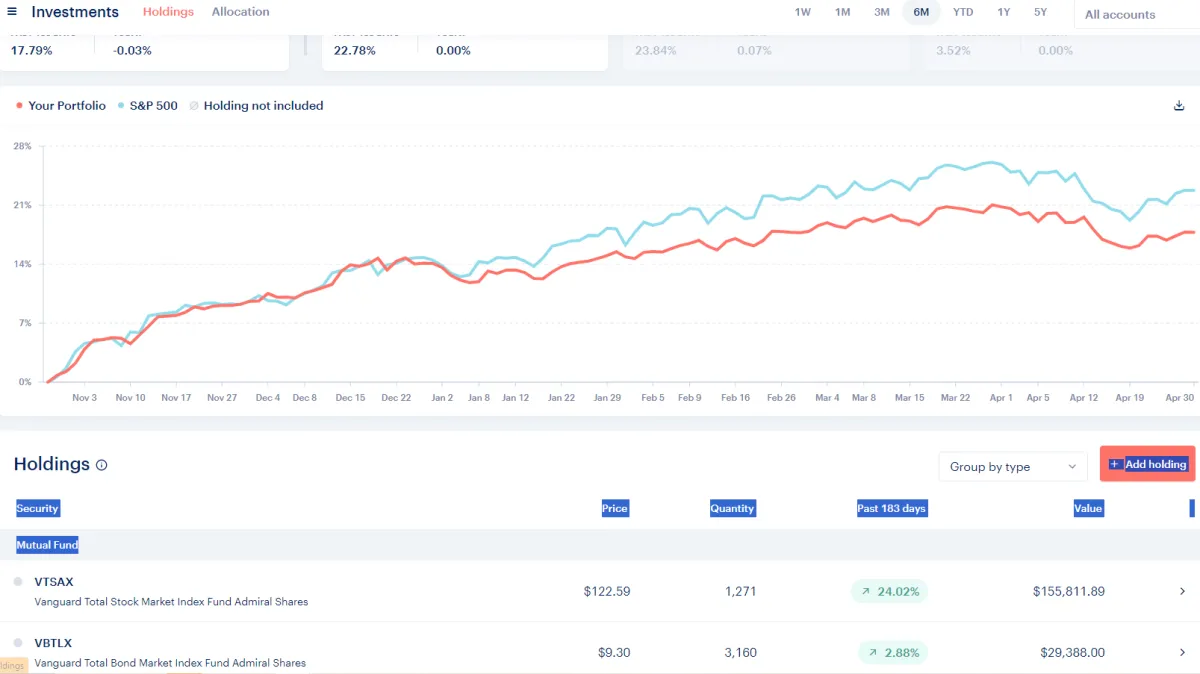

INVEST

Learn how to optimize which type of investment account to open first.

Learn a general rule of thumb to help with efficiently opening your next accounts.

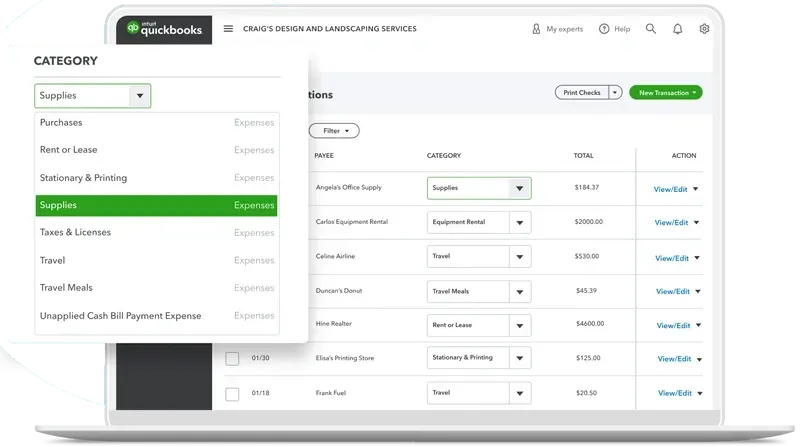

MANAGE YOUR BOOKS

Learn how to set up your books for your business.

Get weekly support with making sure you understand your business numbers!

PROGRAM DETAILS:

WEEKLY OFFICE HOURS

Ask your money questions and get answers from a licensed financial professional. You don't have to guess what to do or try to figure it out on your own. Ask for the help you need to speed up your results and accelerate your wealth building journey.

MOBILE APP

Track your money real time with professional grade technology. Incorporate your goals into the process. Download the app to your phone and watch your budget, debt payoff plan, savings and investing improve.

ON-DEMAND VIDEO LESSONS

NEW!!! Learn how to put your money to work so you don't have to work as hard. You don't need multiple jobs to retire sooner, you need multiple ways to accelerate income coming in. Learn the fundamentals of managing your money with video training at your own pace.

Essential

1:1 Onboarding & Welcome Call

Mobile App To Track Progress

Weekly Live Office Hours - Q&A and Lessons

Access to Private Slack Community

Weekly Text and Email Reminders

On-Demand Personal Finance Video Courses (NEW!)

1 Annual 1:1 Coaching & Progress Session

Entrepreneurs

1:1 Onboarding & Welcome Call

Mobile App To Track Progress

Weekly Live Office Hours - Q&A and Lessons

Access to Private Slack Community

Weekly Text and Email Reminders

On-Demand Personal Finance Video Courses (NEW!)

On-Demand Business Finance Video Courses (NEW!)

Quickbooks Simple Start Included! (NEW!)

Monthly Grant List (NEW!)

1 Annual 1:1 Coaching & Progress Session

Benefits of the Breakthrough Program

Financial Expertise

Get professional help and guidance from certified advisors with years of experience.

Educational Resources

Overcome the years of financial illiteracy with credible resources to make learning simple.

Personalized Support

Get your specific questions answered instead of just general information on the internet.

Financial Stability

Finally break the feast and famine roller coaster of the paycheck-to-paycheck cycle.

Peace of Mind

Find peace when you overcome financial chaos and have a clear understanding of your money.

Connection

Develop relationships with other women who are on a mission to improve their finances.

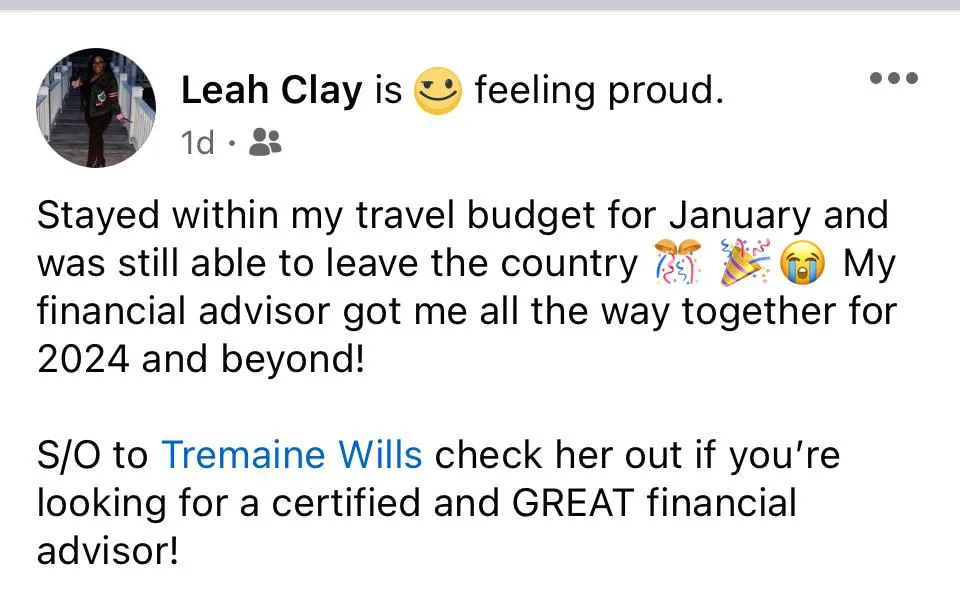

Meet The Lead Advisor: Tremaine Wills, MBA, CFEI

Tremaine Wills, MBA, is an Investment Advisor, Financial Planner and Speaker committed to helping close the wealth gap! She is also a Certified Financial Education Instructor and 2x Investopedia Top 100 Advisor who has been featured in many notable publications.

Tremaine is passionate about building wealth in our community and providing education on how to retain the wealth we are building. This passion led her to create Favor & Finance, a financial literacy education and digital content community focused on helping women entrepreneurs manage their money better and get back to enjoying life.

This introductory program is the first major milestone for families that want to ultimately continue building their assets and possibly become millionaires. Tremaine believes that wealth begins with taking the first step. If you can get to $10k saved, you can also become a millionaire.

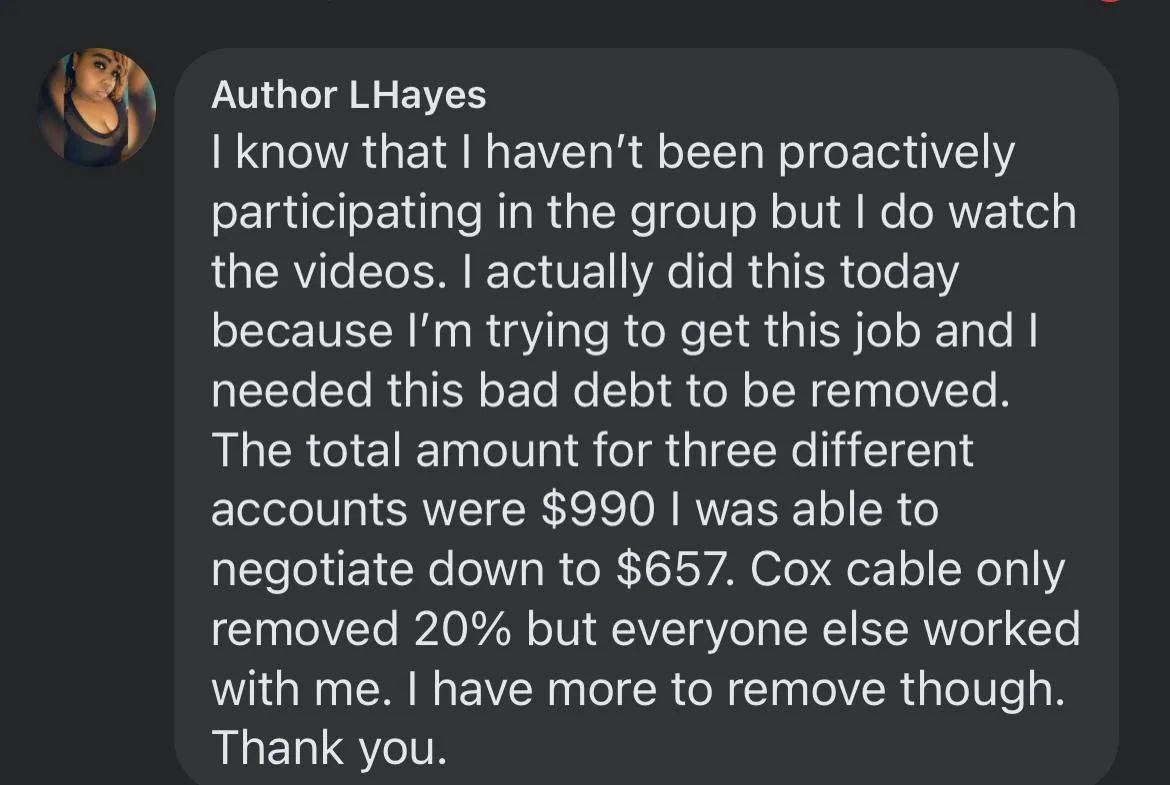

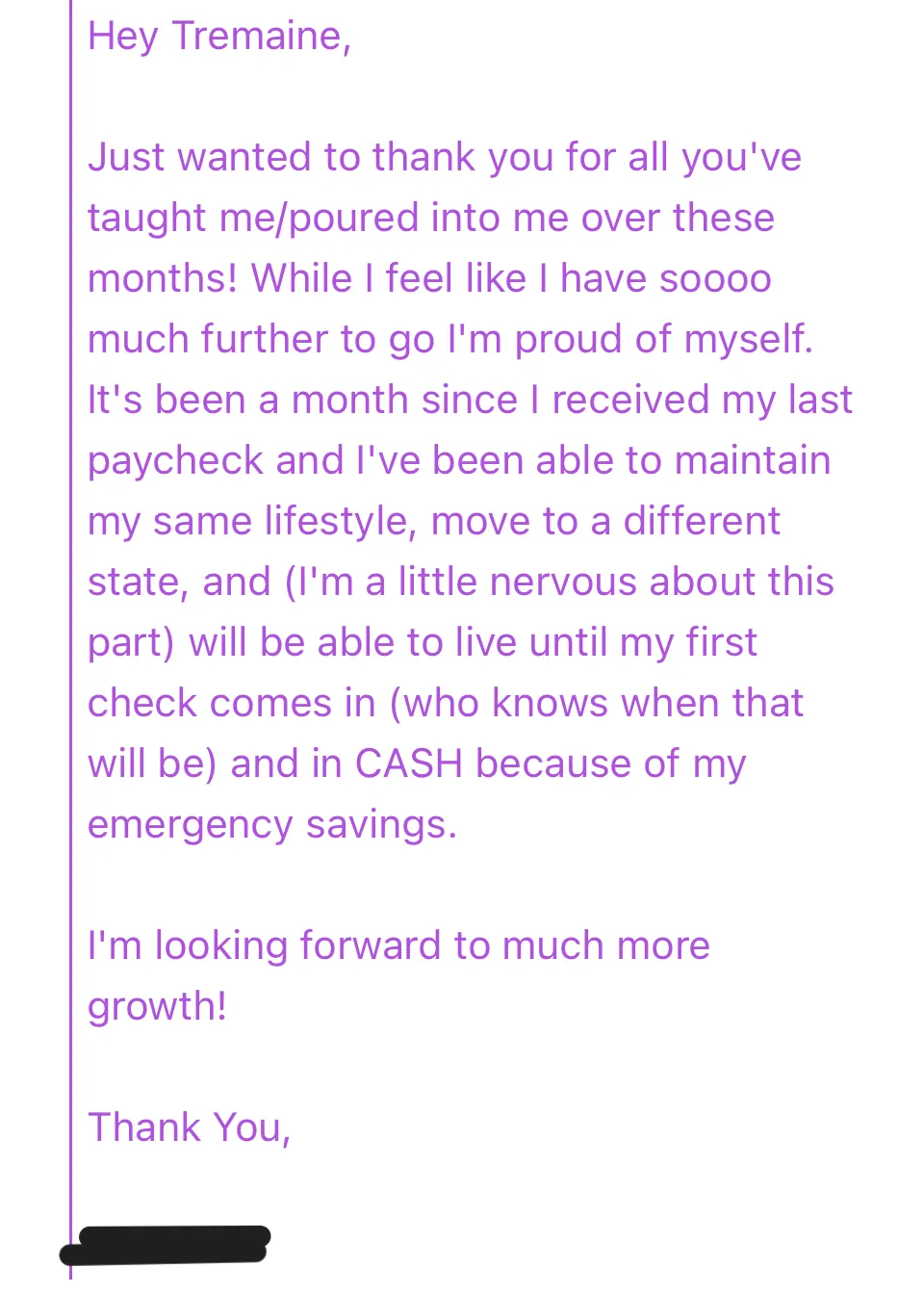

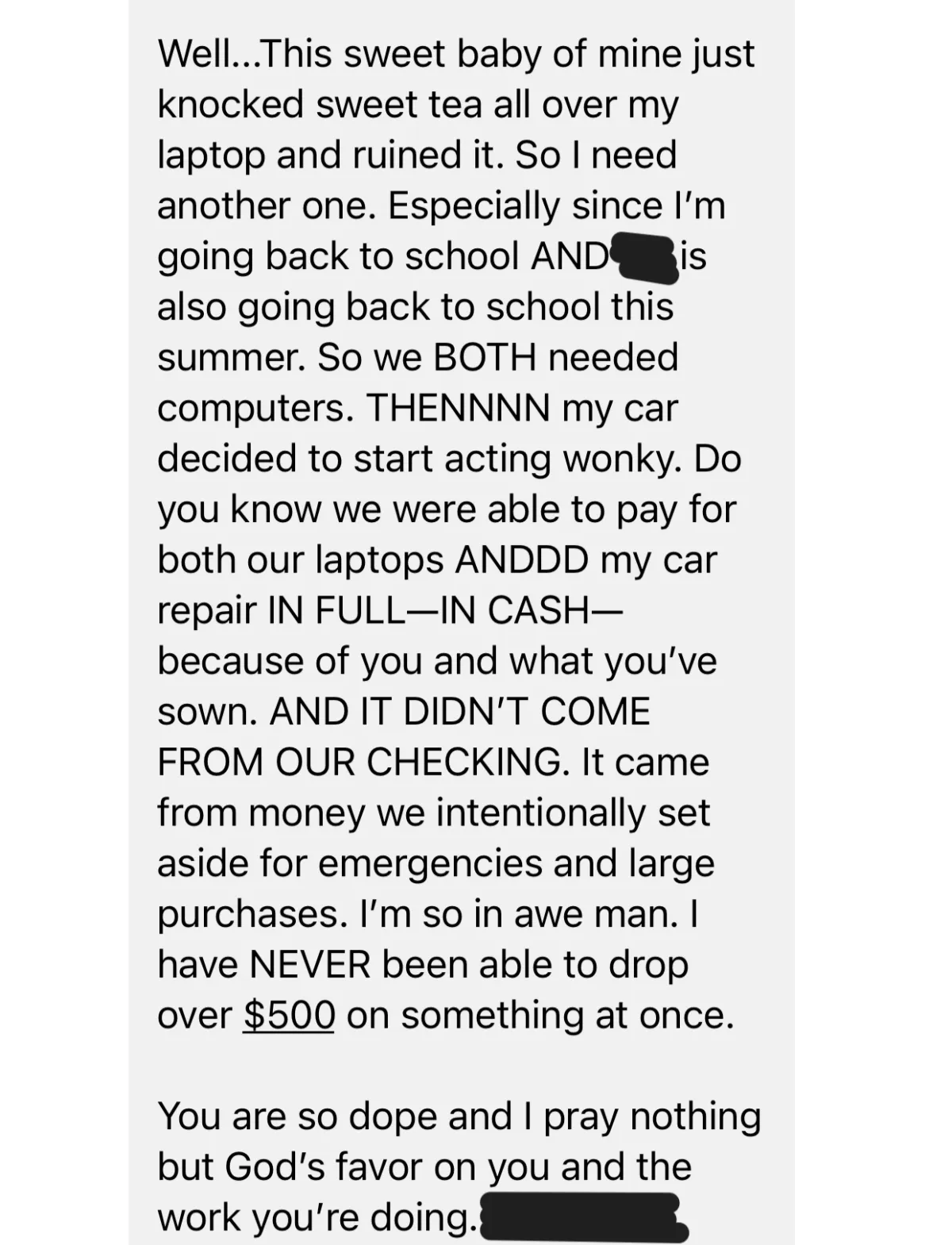

WHAT ARE CLIENTS SAYING?

Note: finances are personal and sometimes a sensitive topic. Our team takes that very seriously. We love celebrating you but we don't want you to fear that your financial situation will be made public without your consent, even if it's good news! If the feedback was shared with me or my team privately via DM or email, we cropped or blacked out the name to maintain confidentiality. If you see names or images, the person has posted on a public social platform.

Frequently Asked Questions

What is the Breakthrough Financial Coaching and Accountability Program?

A program designed to help participants manage their finances effectively, including debt payoff, savings and investing through a variety of tools and community engagement.

What features does the program include?

Features include access to a mobile app for financial tracking, live weekly trainings and on demand video training.

How often can I ask money-related questions?

You can ask your questions live during the weekly Office Hours, in the private slack channel or via our dedicated support email.

How do I cancel my membership?

You can cancel your membership by emailing [email protected].